The Real Estate Professional Status: Everything you need to know

A big shout out to Brandon Hall of the Real Estate CPA for co-authoring this article with Hemlane.

Getting your tax game in order is critical for real estate investors. The real estate professional status designation allows investors to claim certain expenses on their taxes that they may not have been able to before. Simply put, the real estate professional IRS designation means that you operate a real estate business, and you work in that business on a regular basis.

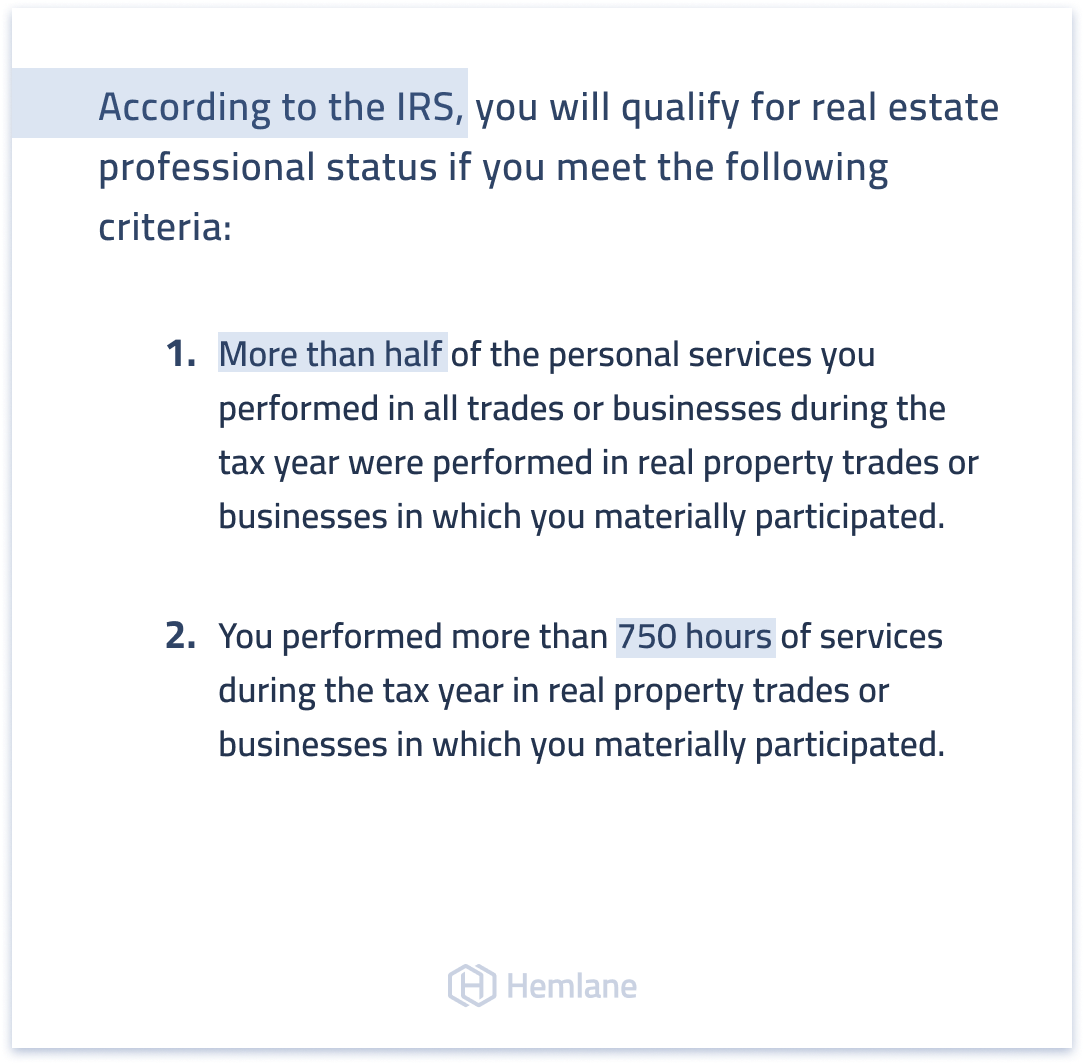

According to the IRS, you will qualify for real estate professional status if you meet the following criteria:

- More than half of the personal services you performed in all trades or businesses during the tax year were performed in real property trades or businesses in which you materially participated.

- You performed more than 750 hours of services during the tax year in real property trades or businesses in which you materially participated.

This has meaningful implications for real estate investors operating a real estate business, but there are some uncertainty and questions around this designation. Let’s get into the real estate professional definition, rules, tax deductions, and best practices.

Real estate professional definition

If you’re a property manager or real estate investor who materially contributes to, and works in, your real estate business, then you likely qualify as a real estate professional according to the IRS.

To obtain the real estate professional status designation, you need to spend more time in a real estate trade or business than any other job. This can make it beneficial for married couples or common-law partners, but more on that later.

To qualify for the real estate professional designation, you will therefore need to spend 50% or more of your personal services in the real estate business. You can’t have a full-time job and claim the status. You can have a part-time job, but you need to be able to prove in an audit that you spent over 50% of your time materially contributing to your real estate business.

What is a “real property trade or business?”

Unsurprisingly the rules around what qualifies as real estate business activity are kind of vague. According to section 469(c)(7)(C) of the IRS code:

Real Property Trade Or Business — For purposes of this paragraph, the term “real property trade or business” means any real property development, redevelopment, construction, reconstruction, acquisition, conversion, rental, operation, management, leasing, or brokerage trade or business.

Property management businesses will fall into the “management” category above. This means that, as a property manager, you are participating in a real property trade or business and the hours you spend participating will count toward the 750 hour test and “more time in real estate than anywhere else” test.

Be careful thinking all hours count toward the two tests. Education and research hours often will not count nor will infrequent travel time (like visiting an out of state rental property). But time spent working in and on your property management business will generally count toward the two tests to qualify as a real estate professional.

An important rule of this designation is that the burden of proof falls on you, the real estate investor, not your accountant, to prove that you qualified in the event of a tax audit.

Pro Tip: The point is, you need to be tracking your time on a spreadsheet, calendar, or some time tracking app in case of an audit. Keep your receipts organized in one place by using a filing system, or online tool like Hemlane, that will allow you to have everything in one spot and properly categorized. By using these types of tools, you’re mitigating risk by streamlining your processes.

You simply need to be able to prove that you’re following the real estate professional designation rules, and that you satisfied the hours and material contribution conditions.

Real estate professional tax deductions

Qualifying as a real estate professional can produce huge tax benefits. When you qualify as a real estate professional and materially participate in your own rental activities, your rentals will be considered “non-passive.”

You or your spouse’s W-2 income and your business income are “non-passive.”

What this equates to is your rental losses being able to offset your other income without limit.

Normally, rental losses are passive and can only offset passive income. Landlords often don’t have enough passive income to absorb the full amount of passive losses, so the excess rental losses are “suspended” and carried forward.

But when you qualify as a real estate professional and materially participate in your rental activities, your rental losses are non-passive and can offset any type of income.

As an example, let’s assume you have a net income of $150,000 from managing your properties. Let’s also assume you have four rental properties that produce $20,000 in passive losses (thanks to depreciation!). If these losses are passive, you cannot use them to offset your $150,000 of net income. But if you qualify as a real estate professional and you materially participate in your rentals, your rental losses are non-passive. The $20,000 of non-passive losses can then be used to reduce your taxable income down to $130,000… and in this example, it likely saves you ~$6,000 in taxes!

Property managers and those who decide to manage their properties themselves have a leg up on everyone else attempting to qualify as a real estate professional.

In a normal situation, a landlord would hire a property manager to manage their rental properties. Even if that landlord could qualify as a real estate professional (maybe they are a full-time real estate agent or flipper), they will have a hard time demonstrating that they materially participate in the rental property that the property manager manages… because, well, the property manager is doing most of the work.

But most real estate investors (72% according to the 2018 Rental Housing Finance Survey) manage their own properties. So not only do you get to log hours toward the 750-hour test as a property manager, but because you self-manage your rentals you’re also deemed (typically) to be materially participating.

Material participation is often what stops rentals from being non-passive. A full-time real estate agent is a real estate professional (two tests met: (1) 750-hours and (2) more than half their time in real estate). But if they don’t also materially participate in their rental properties, their rentals are still passive.

Here’s a link to The Real Estate CPA’s 12,000 word guide on real estate professional status.

Real estate professional designation best practices

There are some critical best practices to consider when qualifying for or using the real estate professional designation.

Marriage or Common Law - If you have a spouse, then the designation of a real estate professional becomes easier to obtain. Only one person in the couple needs to qualify for the designation but you can still claim all the real estate deductions associated with the real estate professional designation. Whereas with a single person they need to fulfil the entire criteria on their own, with a couple one person can fulfil it and the other can continue working a full-time job.

Material participation - What does material participation in the real estate professional designation really mean? Good question. You have to have a role in the day-to-day management of the real estate business, or participate in some aspect of it such as maintenance, leasing, and acquisition. You can’t be passive, you have to be actively involved in the operations and management of your real estate business. Property Management software can be used to demonstrate that you are actively involved in the operations.

Passive investor - If I’m a passive investor in a real estate deal, or participate in crowdfunding, does that qualify for the real estate professional designation? In short, no. You need to materially participate in the day-to-day operations of the real estate business itself to qualify.

LLCs - LLCs help with liability and asset protection, but don’t factor into your status or qualification as a real estate professional. Therefore, if you own an LLC that holds your properties, it won’t change the requirement that you materially contributed to the management and operations. If you meet that requirement, then whether or not the property is held in an LLC is irrelevant.

Year-by-year - The real estate professional designation is not a one-time shot, you need to be able to prove every year that you met the above criteria. Just because you obtained it last year, doesn’t mean you’ll get it this year.

How to benefit from the real estate professional status

First, if you have a full-time job, it’s almost impossible to qualify for the status. You have to have materially participated in the operations for 750 hours or more, and spend more than half your time doing this.

Real estate investors can still use local management support, but will be required to prove material contribution. Further, as long as you own 5% or more of a real estate business, you can qualify for the real estate professional status so long as you materially perform duties in the following categories and meticulously log your hours and tasks:

- Real property development

- Redevelopment

- Construction

- Reconstruction

- Acquisition

- Conversion

- Rental

- Operation

- Management

- Leasing

- Brokerage trade or business

There's no doubt that technology is making it a lot easier for real estate investors to get the real estate professional status by enabling self-management. Tools like Hemlane achieve this by allowing investors to remotely manage using innovative software, access to leasing agents, and a 24/7 repair center. Hemlane provides an optimal solution from a tax and liability perspective, and if you’re remote investing, you can still achieve the professional status.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.