Post-COVID: What the Past 3 Months of Rent Collection is Telling Us

Regardless if you are a rental property investor or manager, chances are the headlines over the last several months have given you reason to worry about your bottom line.

Most of us are also experiencing “Coronavirus fatigue” and are wondering what the new normal is going to look like as physical distancing restrictions lift. Some of us will be heading back to the office, while others will permanently remain remote, and still others won’t have the same job to go back to. These unprecedented times will go down in history as fundamentally changing how our society looks and operates.

The full impact on rent collection is yet to be seen. Below we provide analysis of COVID’s impact the last 3 months. We also outline tips and strategies for mitigating rent loss and factors to consider when looking after your bottom line.

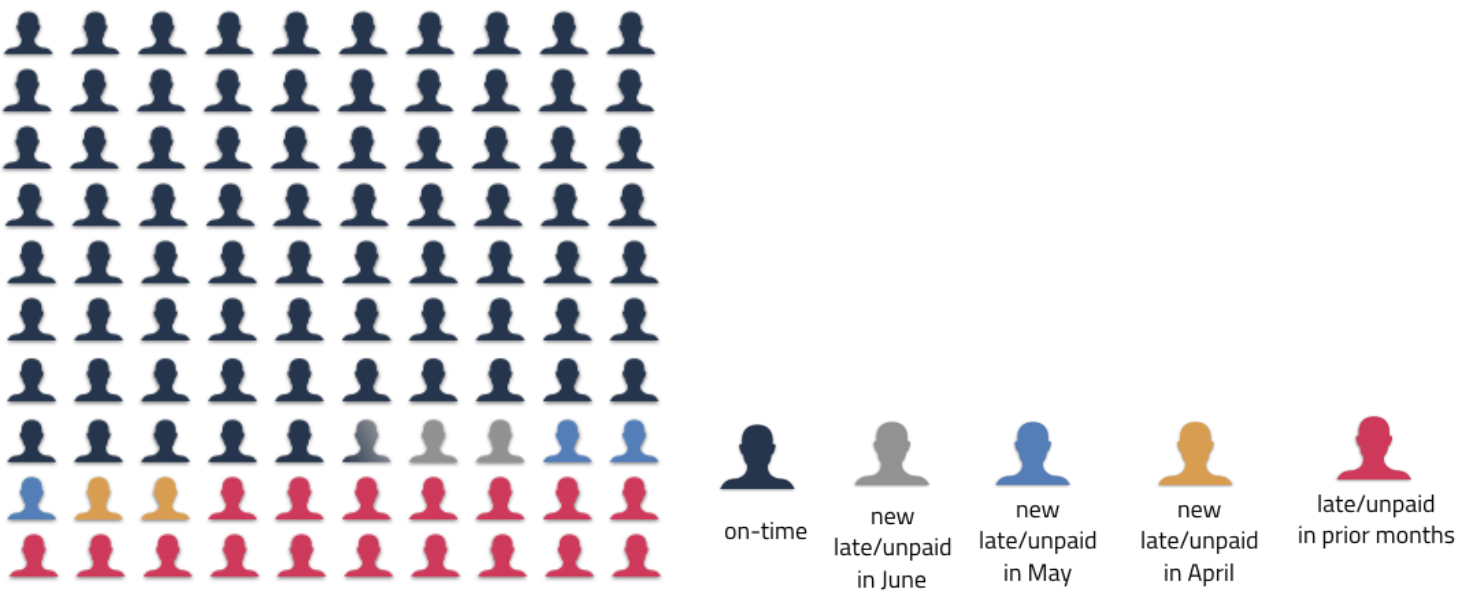

24.5% of tenants were late or defaulted on rent in June

Many news sources have been reporting 30%+ defaults on rent payments starting in March. Many reports fail to mention that a large portion of residential tenants defaulted regularly before this crisis started.

Hemlane operates across all 50 U.S. states and serves the mass market of residential rentals from single family homes to 100 units. For the month of June, we currently see 24.5% defaults (compared with data from Apartment List at 30% and NHMC at 29%) -- and we expect this number to go down by the end of the month.

Hemlane’s Nationwide Figures for June

Source: Hemlane

<8% were affected by COVID

You may notice in the data above that less than 8% of late or default rent payments are directly attributable to COVID.

Despite reported unemployment numbers above 15% across the U.S., we are not seeing as large of an impact on residential rent payments as was previously expected. For April and May, we saw more than 97% of historically on-time payments collected on the Hemlane platform. This is in line with other reports.

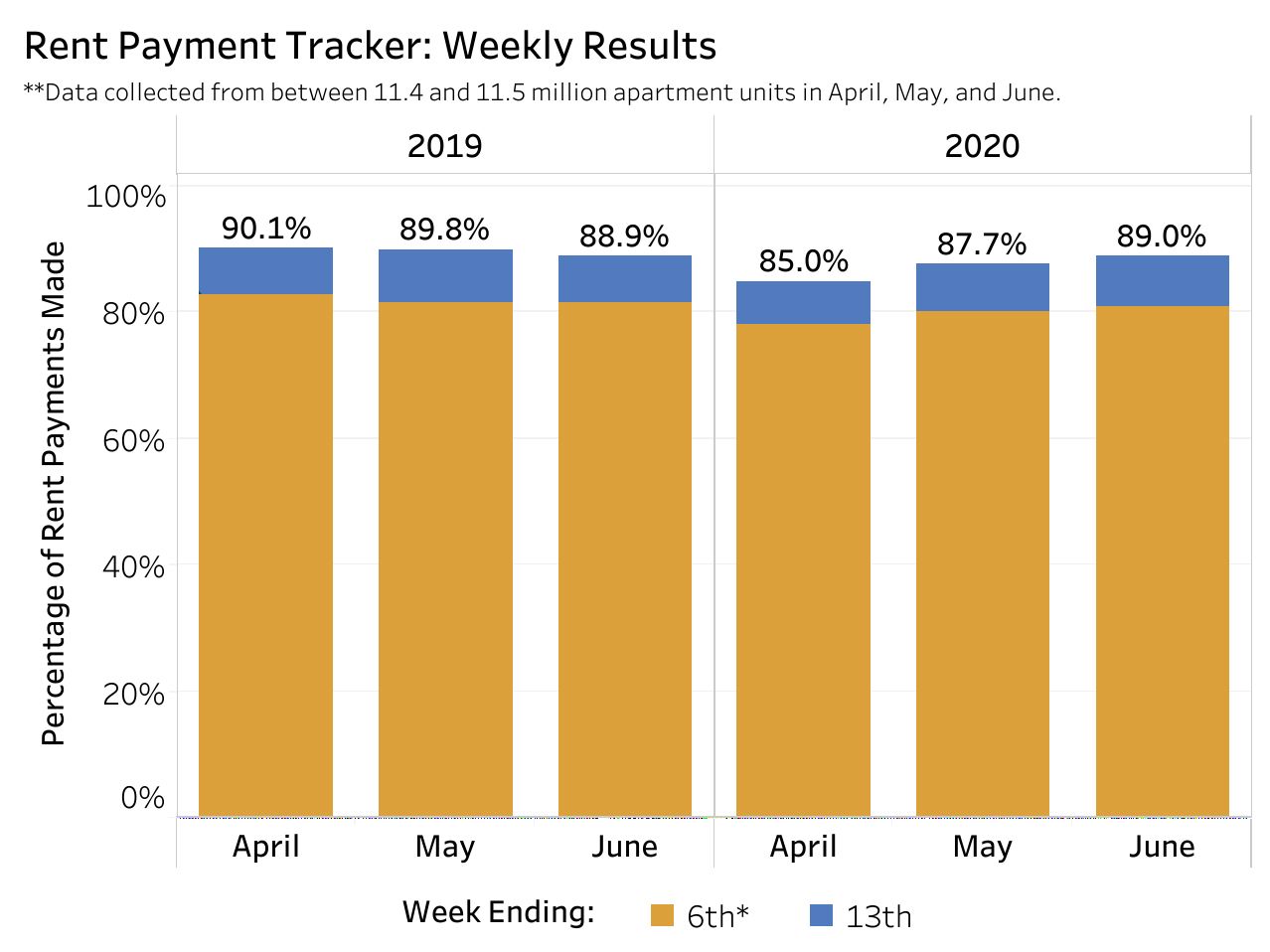

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker surveyed 11.5 million professionally managed apartment units across the country and found 80.8 percent of households made full or partial rent payment by June 6, compared with 80.2 percent by May 6 the previous month. By May 27, this number was up to 93.3 percent and we could very well see similar numbers for June.

Key Takeaway: Less than 8% of pre-COVID on-time payments were late or defaulted

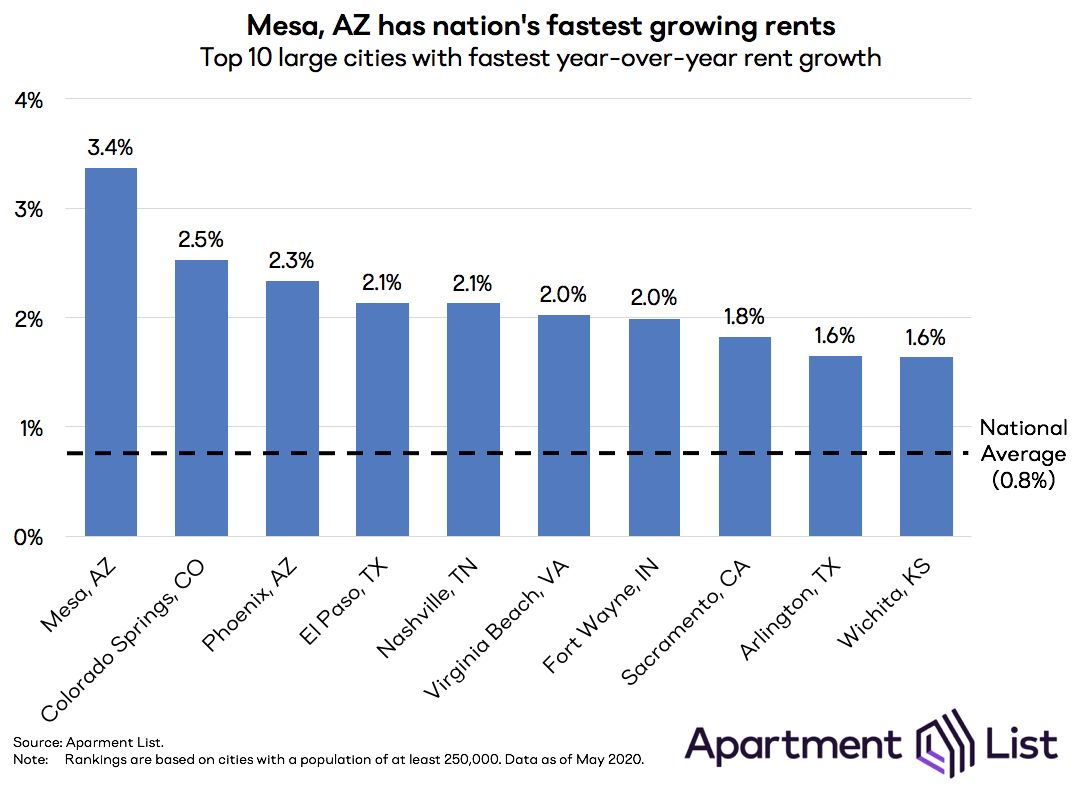

Rental price impacts

According to Apartment List, while rents are increasing at the slowest pace they have in the last 5 years, they are still outpacing the Consumer Price Index at 0.8% compared to 0.3%, on average. Below are 10 cities experiencing higher rent growth than the average, with Mesa currently at the top.

Source: Apartment List

Pro Tip: If you’re reassessing your rental price, check out our guide for Pricing Your Rental. Websites like Apartment List also track rental rates by city.

According to Hemlane data, tenants are 4% more likely to be late or default if their rent is less than $1,000 per month. There are several reasons for this, including debt to income ratios (for example, many may live paycheck to paycheck with little to no savings to cover them in cases of lost income), as well, the types of employment these groups have tend to be in industries most impacted by COVID (for example, restaurants, tourism, and labour).

“Forty percent of households that make less than $40,000 annually have seen job losses.”

-- Federal Reserve Chair Jerome Powell

With those numbers, it is important for rental owners to stay in close communication with their tenants and proactively mitigate, if possible. Additionally, federal stimulus packages, including $600 a week for the unemployed, could help low income tenants cover their rent obligations.

Key Takeaway: Rental prices are still increasing, though not as much in the last 5 years. The most impacted renters are those whose rents are less than $1,000 per month.

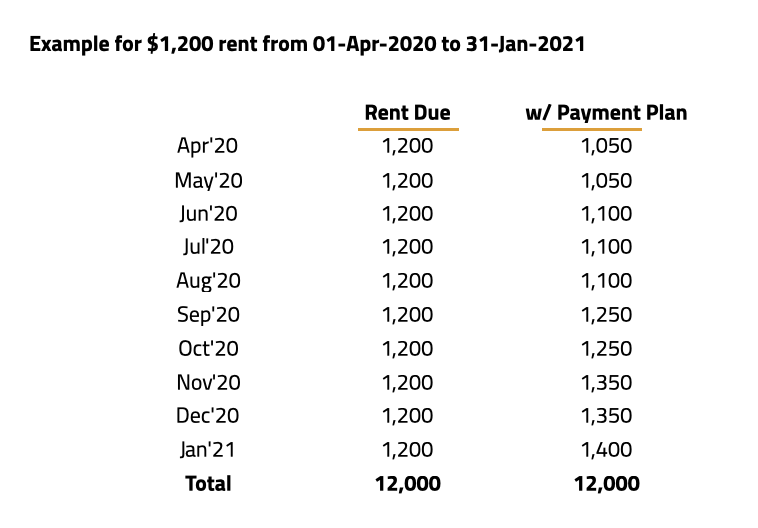

Alternative payment plans for those affected

First, let’s address the myth that tenants do not need to pay rent during this time. Currently, tenants are still obligated to pay rent and only certain situations allow for deferred payments. These include:

- Reduced hours / pay

- Additional child care expenditures due to school closures

- Health care expenditures from immediate family getting the virus

- Expenditures from government ordered emergency measures

Given our constantly changing circumstances, it is now more important than ever for landlords to keep digital records of communications. This includes putting any agreements made with tenants in writing, as well as keeping up to date with tenants’ situations. If a tenant is unable to pay their rent, they must first:

- Declare, in writing, that they cannot pay rent due to COVID-19

- Retain documentation and evidence

You can also put together a Rent Payment Delay Agreement with your tenant. We have provided an example below.

Pro Tip: Companies like Till will work with renters to analyze their cash flow and break their payments up into smaller bites that will work best for them to make their payments.

As of today, tenants must pay according to plan or risk eviction once moratoriums are lifted.

Other options include:

- Use the security deposit towards rent outstanding.

- Consider allowing your tenants to break their lease early. It is highly recommended you do a careful assessment of the rental market before taking this step. A licensed leasing agent can assist with this.

For additional strategies on mitigating rent default, see our article on Everything Landlords and Managers Need to Know About Coronavirus.

Key Takeaway: Stay up to date on your tenants’ situation and put proactive measures in writing.

What could impact rents

Below are scenarios that could impact rent collection in the coming months. It is important to stay informed so that you can stay ahead.

Increased rental defaults

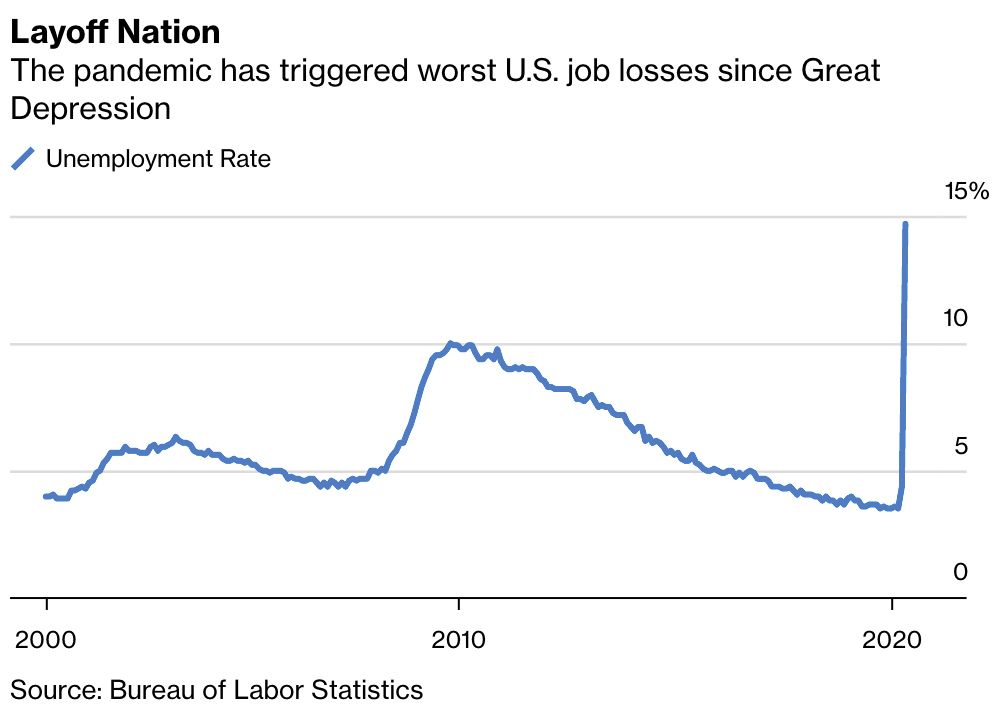

With reported unemployment numbers increasing above 15% and 5% default rates, we could be seeing a backlog of renters on the brink of defaulting.

June 8, 2020 update: there have been additional reports that unemployment numbers have been underreported. As discussed above, remain up to date on your tenants’ situation and ensure agreements and payment plans are put in place and in writing.

Slow economic recovery

If renters have reduced unemployment benefits or cannot find work, it will impact their future ability to pay rent. This includes the forgivable loans offered to companies as part of the trillion-dollar stimulus package. With the requirement to retain staff until October, many of them may be let go at that time if business has not picked up by then.

Government stimulus initiatives

The unemployment benefits from the Coronavirus Aid, Relief, and Economic Security Act passed in March are set to expire in July. If the government drastically reduces or stops these stimulus initiatives, it could very much impact how quickly the economy recovers.

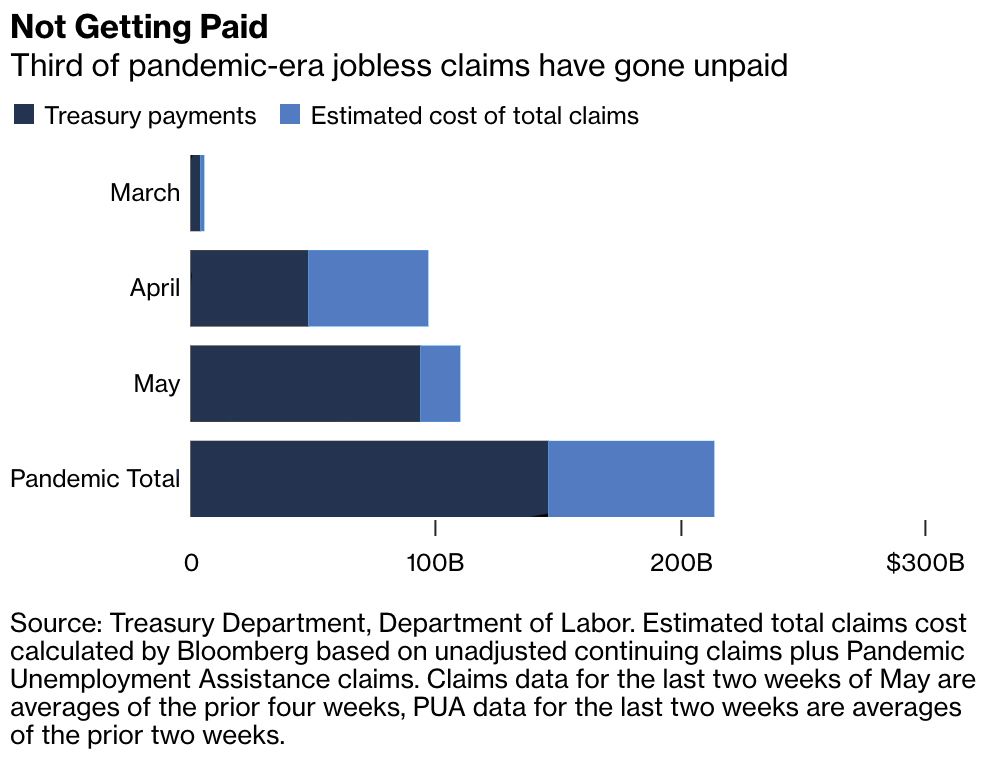

This is highly unlikely until the economy demonstrates it can sustain its own recovery, and recent reports have also highlighted that a third of current jobless claims have yet to be paid.

Source: Bloomberg

Uncertainty

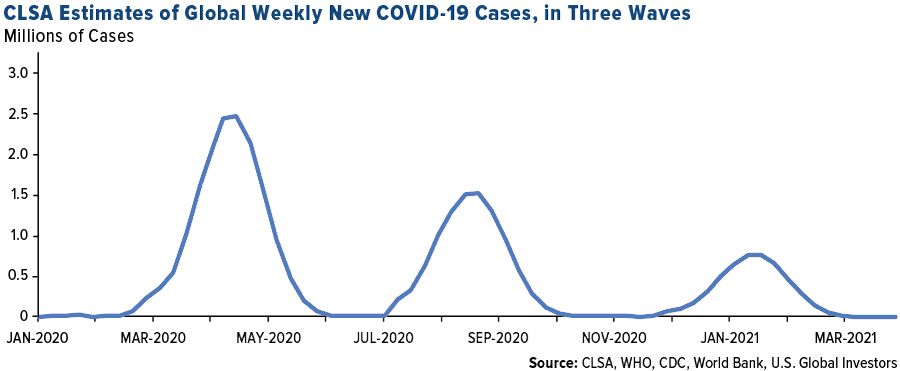

No one knows with certainty how long this will last and the only long term solution is a vaccine. If we look at historical pandemic waves, we will most likely see two more waves, through to early 2021. Fortunately, our first responders are much better equipped now to deal with subsequent waves and we have a much better understanding of how the virus is spread and ways to mitigate our risk of catching it.

For more information, the John Hopkins Coronavirus Resource Center is a great resource.

Extended unemployment

If high unemployment extends through 2021, it may impact the ability of renters trying to make ends meet.

Source: Bloomberg

Housing boom post-coronavirus

Would-be home buyers may see low interest rates as an opportunity to make that first home purchase. However, recent investments by large market players expanding and entering the “build-to-rent” space indicate that there is an expectation of renters continuing to rent.

What could benefit rental owners

Below we have highlighted additional items to consider when looking ahead.

Easing of shelter-in-place orders

Many localities are easing current restrictions and businesses are ramping up operations. This will put the economy back in gear and economists expect jobs creation to align with reopenings. We see examples of this in May’s job numbers, with more than 2.5 millions jobs added bringing national unemployment down to 13%.

Continued stimulus measures

The $2 trillion CARES Act provided stimulus checks and extended unemployment benefits. These concerted efforts have supported tenants through:

- Expanded unemployment benefits (beyond current July expiration date)

- Stimulus payments

- Forbearance measures.

First-time home buyers

Making purchasing decisions during these uncertain times still poses a high perceived risk for many would-be first-time home buyers. For these individuals, it means they will continue to rent and hold off on purchasing decisions until there is more stability in the market.

Increased technology adoption

Any previous resistance to digital applications is waning with a surge in use of technologies to enable communication and maintain physical distancing. Real estate technologies increasing in popularity and use include:

- Virtual showings

- Online applications and credit screenings

- Electronic transactions and rent collection

- Maintenance and repair management

All of these can be leveraged to increase your Net Operating Income (NOI) through efficiencies and cost savings.

Working from home as the new normal

Note that for many Americans, this means working remotely from their rental home. Living and working from home may incentivize tenants to take better care of their residence, as well as place higher priority on paying rent on time and in full.

Leveraging technology

The bottom line is, technology is becoming more of an essential part of property management.

Rental turnover

For marketing your property, including pictures of every room and space is now more important than ever. Many prospective tenants will be looking to maximize their space and accommodating a work environment will be a value-add.

Incentivize your current residents to help with the leasing process. They can host video tours for a fee if the tenant signs a lease, as well as provide additional cost savings:

- Able to pre-lease before the rental is available

- Current resident is incentivized to clean their place

- Resident is likely home and happy with extra cash

- Resident feels more inclined to leave the place in good condition

Pro tip: Consider hiring a professional to assist with leasing to save you money and headaches in the future. Professionals can source you qualified tenants, perform inspections, as well as assist with the lease. Note as well that if someone is physically showing your property and answering questions, a real estate license is required in most states.

Read more on Best Practices for Rental Lease Contracts.

And remember, patience is key as turnover will most likely take longer and many tenants may opt to remain in their current homes given many U.S. States still have stay-at-home orders in place.

Rent Collection

Digital payment options have been increasing over the past several years and physical distancing requirements will speed up the transition from collecting rents by cash, money order, and check. It is important to educate yourself on secure methods for online rent collection. You can read more about the risks on Venmo, Paypal, Zelle, Direct Deposit for Rent Collection.

Maintenance, Repairs and Inspections

This is a great time to have your tenants log photos and list repair needs. Prepare for requests that can be deferred and know what constitutes an emergency (here are some guidelines on what constitutes an emergency).

Minor repairs can be done by your tenants, reducing exposure and your service calls. Here are 7 Summer Rental Maintenance Tips.

“The best preparation for tomorrow is doing your best today”

-- H. Jackson Brown Jr.

Lock down measures have given most of us a new normal of living, working, and playing. Despite the uncertainty about our future and what that will look like in the days to come, there are indicators things are not quite as bad as they seem.

By adapting to our new environment and proactively adopting new practices for conducting business, there are many strategies you can implement today to mitigate your risks and set yourself up for success.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.