Net Operating Income Formula (NOI) + Calculator

Today there’s more demand for good investment real estate than there is supply. Days on market are at all-time lows, prices are increasing, and supply is getting lower due in part to rising material costs. In short, it’s harder to find good investment opportunities.

In the hot real estate markets, investors who take too long analyzing a potential deal can lose the property to another buyer able to act fast. One of the best ways to quickly understand if a property makes investment sense, is the net operating income (NOI) formula.

In this article we’ll explain how the NOI real estate formula works, some potential drawbacks of NOI to be aware of, and how to use NOI in other real estate calculations to quickly decide whether or not a property is worth a detailed look.

What is Net Operating Income (NOI) in Real Estate?

Net operating income (NOI) in real estate is a formula investors use to quickly calculate the potential profitability of a rental property. Similar to cash-on-cash return, the NOI gives investors a quick glance at the profitability of an asset.

By using the NOI real estate formula, an investor can easily make an apples-to-apples comparison among similar properties in the same market. NOI ignores the effect leverage has on your operating income and doesn’t take into account variable expenses such as CapEx and property maintenance. This allows you to understand the non-variable profitability of your potential investments, and compare various properties.

Net Operating Income vs. Net Income

Sometimes investors confuse real estate NOI with net income. Using the wrong number in the formula will lead to missed opportunities by understating the true potential financial performance of the property.

NOI is the difference between operating income and operating expenses, excluding other variable investor-specific expenses such as mortgage interest, tenant improvements, capital expenses, and personal income taxes.

Net income is the difference between operating income and operating expenses plus all other expenses.

Net Operating Income (NOI) Formula for Real Estate

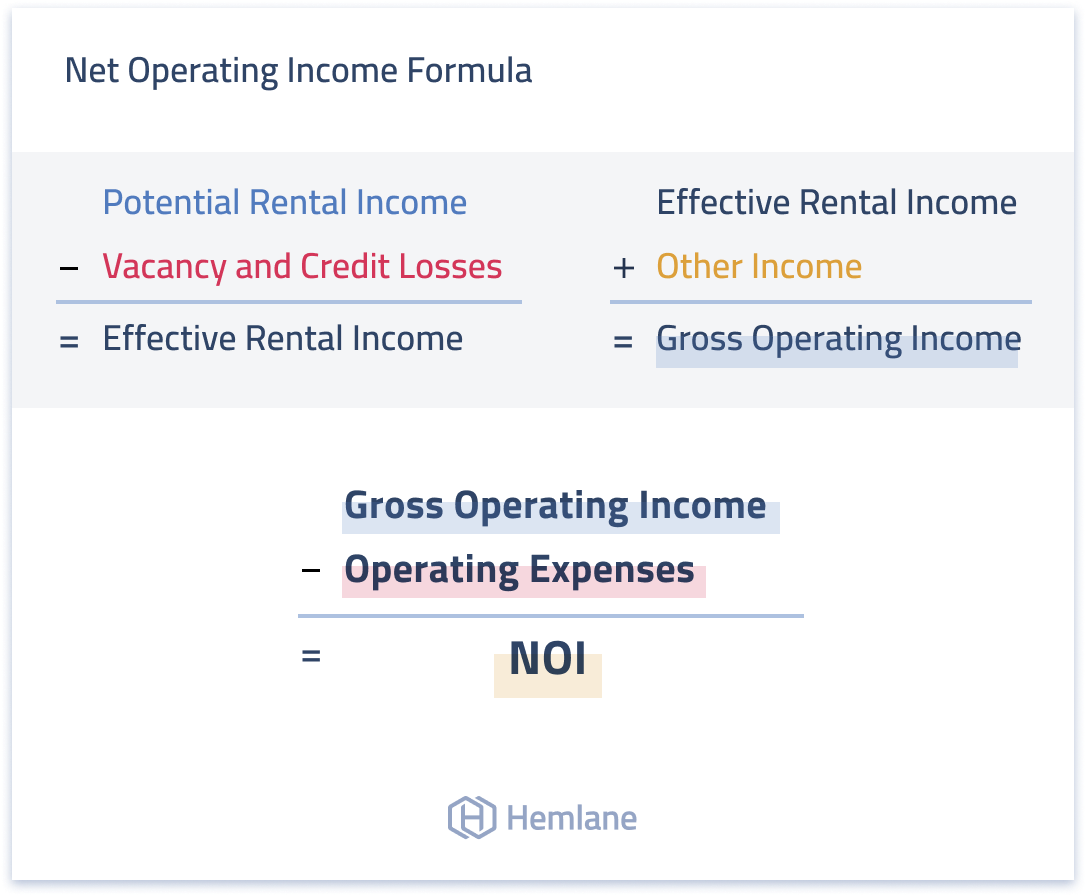

The NOI formula in real estate is easy to use and understand:

Net Operating Income Formula

- Potential Rental Income – Vacancy and Credit Losses = Effective Rental Income

- Effective Rental Income + Other Income = Gross Operating Income

- Gross Operating Income – Operating Expenses = NOI

How to Calculate Net Operating Income

To calculate the net operating income you’ll need to know the property’s potential rental income, estimated vacancy and credit losses, miscellaneous income, and normal operating expenses.

1. Potential Rental Income

Potential rental income (PRI) assumes the property is fully occupied 100% of the time and that the tenant always pays their rent in full. If the property is vacant investors can use the fair market rent for similar properties in the immediate area.

2. Vacancy and credit losses

Vacancy and credit loss (bad debt) considers factors such as rental income lost due to vacant property between tenant turns, and tenants defaulting on their lease payments.

3. Effective rental income

Effective rental income is the rental income a property owner can expect to collect after taking into account losses from vacancy and credit losses.

4. Other income

Depending on the type of property, other miscellaneous income generated could include late rent payment fees, pet fees, parking, laundry and vending, and storage fees.

5. Gross operating income

Gross operating income is the sum of the effective rental income from tenant rents plus other miscellaneous income generated by the rental property.

6. Operating expenses

Operating expenses are the costs of operating the property so that the estimated rents are collected. Typical operating expenses include marketing, leasing, and property management fees, routine repairs and maintenance, property taxes and insurance, utilities, and professional service fees directly related to operating the property.

7. Net operating income

Net operating income is the final result after subtracting operating expenses from gross operating income.

Now that you understand the inputs into the NOI formula, it’s time to put all your numbers into Hemlane’s interactive NOI calculator.

Items Not Included in NOI

The NOI calculation excludes expenses used to reduce taxable income such as depreciation and one-time capital expenses (CapEx) such as replacing a heating and air conditioning system. Items not included in NOI include:

- Debt service and mortgage interest expense

- Tenant improvements (TIs)

- Capital expenditures (CapEx)

- Depreciation

- Income taxes

Example of Calculating NOI

How NOI works in real life

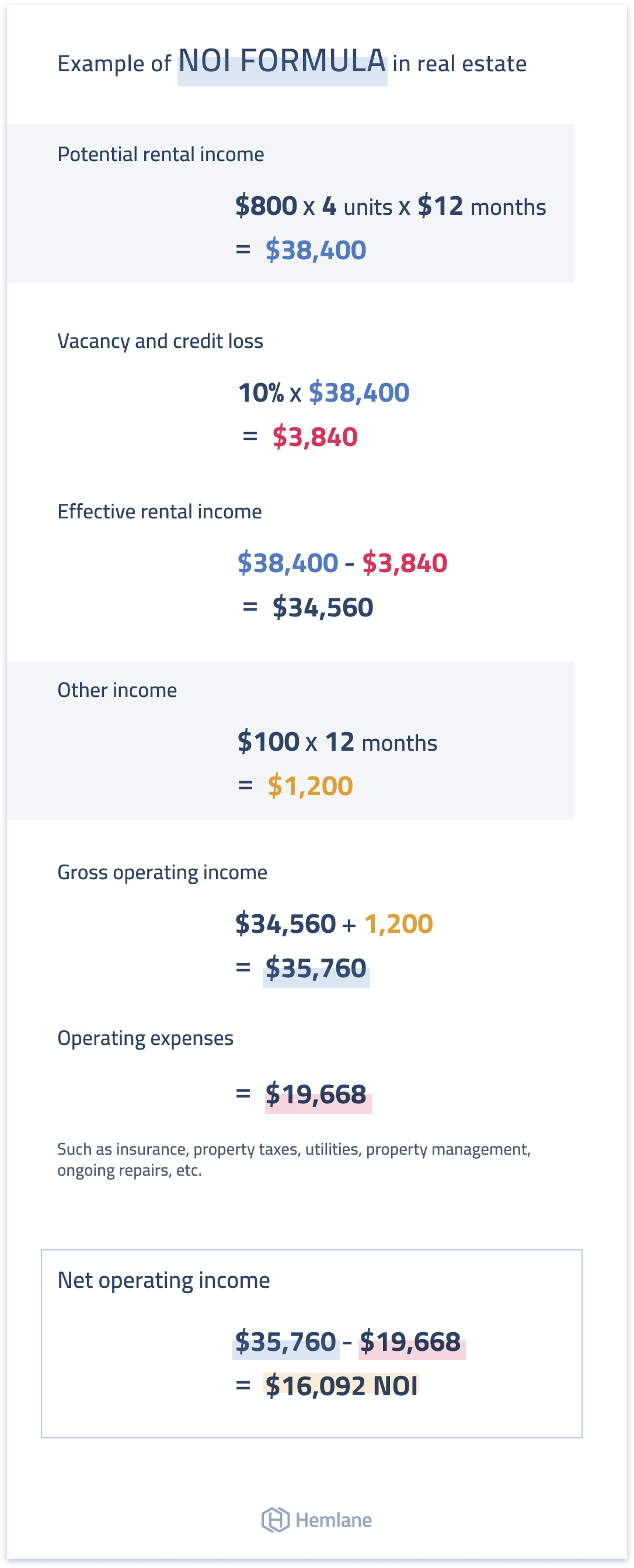

We’ll use a small four-unit multifamily property with the following income and expenses components:

- Monthly rental income per unit = $800

- Other total monthly income from the pet and late fees = $100

- Vacancy and credit loss factor = 10%

- Operating expenses = 55% of gross operating income

Calculating the NOI

By plugging the above income and expenses number into the NOI formula we can determine the property’s expected annual net operating income:

- Potential rental income = $800 x 4 units x 12 months = $38,400

- Vacancy and credit loss = 10% x $38,400 = $3,840

- Effective rental income = $38,400 - $3,840 = $34,560

- Other income = $100 x 12 months = $1,200

- Gross operating income = $34,560 + $1,200 = $35,760

- Operating expenses = $19,668

- Such as insurance, property taxes, utilities, property management, ongoing repairs, etc.

- Net operating income: $35,760 - $19,668 = $16,092 NOI

If you don’t know all of your operating expenses, a good rule of thumb is to use a third (33%) of gross operating income as your estimated number.

Pros and Cons of NOI

Pros of the NOI Formula

- NOI is a quick and easy way to determine whether a property could be a good investment.

- NOI also provides a macro view of the cost of operating the property.

- Lenders use NOI to understand if the property’s cash flow is enough to comfortably service potential debt.

Cons of the NOI Formula

- Sellers can manipulate NOI by treating normal repair expenses and CapEx.

- Over- or under-estimating potential rental income can also lead to misleading NOI calculations.

- NOI may vary based on how well the property is managed.

Real Estate Metrics That Use NOI

Net operating income is also used in several other real estate metrics investors used to measure the financial performance of a rental property:

Cap Rate

Cap rate is another quick and easy calculation real estate investors use to compare the potential return of similar property in the same market:

- Cap Rate = NOI / Property Value

Property Value

Investors can also use the cap rate formula to estimate the value of a property by dividing the NOI by the cap rate for similar properties:

- Property Value = NOI / Cap Rate

Debt Service Coverage Ratio (DSCR)

Lenders use the DSCR to determine how much cash is left over to act as a cushion after paying for normal operating expenses and debt service. As a rule of thumb, most lenders look for a DSCR of at least 1.25:

- DSCR = NOI / Debt Service

Final Thoughts

NOI in real estate is a quick ‘back of the napkin’ calculation investors use to forecast the financial performance of a rental property. The NOI formula is a good way to make an apples-to-apples comparison of comparable properties because it ignores investor-specific expenses such as debt service and capital repairs.

Correctly calculating NOI is critical, because it allows you to analyze potential properties, compare the current ones in your portfolio, and it is also used in other real estate metrics such as cap rate and debt service coverage ratio.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.