Using Gross Rent Multiplier (GRM) Formula to Project ROI

The gross rent multiplier (GRM) is an easy formula to use to uncover which rental properties are potentially the most profitable. What’s most surprising to many real estate investors is that the gross rent multiplier formula can also be used to project ROI.

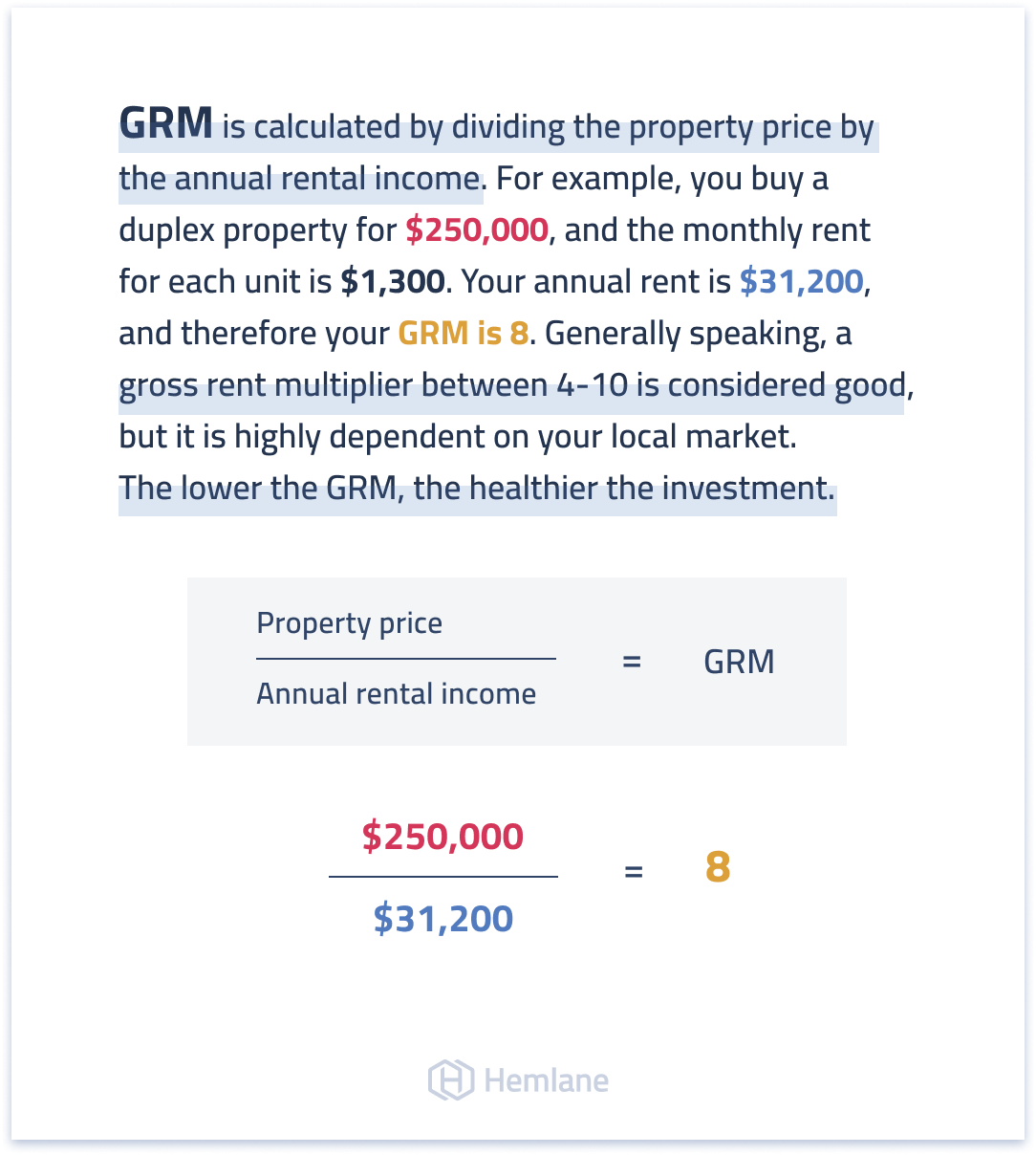

Simply put. GRM is calculated by dividing the property price by the annual rental income.

Gross rent multiplier example: A duplex property is purchased for $250,000, and the monthly rent for each unit is $1,300. Your annual rent is $31,200, and therefore your GRM is 8. Generally speaking, a gross rent multiplier between 4-10 is considered good, but it is highly dependent on your local market. The lower the GRM, the healthier the investment.

In this article, we’ll explain how to use the gross rent multiplier and ROI together to help narrow down your search for the most lucrative deals in your market.

What is ROI?

ROI – which is an abbreviation for ‘return on investment’ – is a ratio or percentage that compares the money you receive from an investment to the money you put into an investment. But just as importantly, ROI measures how efficient or potentially profitable one investment is compared to other alternatives.

For example, let’s assume you have $100,000 in capital available to invest.

If you put the money in a 1-year CD that pays 0.70% interest, your profit would be about $700. By comparison, if you used the same $100,000 to pay all cash for rental property your profit could be around $7,200 per year, depending on rent and expenses.

In this example, income-producing real estate is the more efficient investment because it generates nearly 10.3 times the return ($700 vs. $7,200) than a CD paying an extremely low rate of interest.

How to Calculate ROI

ROI is calculated by dividing the profit returned from an investment by the amount of money paid out of pocket:

- ROI = Cash Received / Cash Invested

Cash received is the profit after all of your bills have been paid, including the mortgage. Using our rental property as an example, you would calculate the ROI like this:

- $7,200 cash received / $100,000 cash invested = 0.072 or 7.2%

Of course, if you finance the property your ROI would be higher.

Using a conservative down payment of 25% ($25,000) your mortgage payment would be about $3,800 per year (principle and interest) and your cash received would be $3,400 after factoring the debt service:

- $3,400 cash received / $25,000 down payment cash invested = 0.136 or 13.6%

Now let’s look at how the gross rent multiplier works, and how to use gross rent multiplier to project ROI.

How Gross Rent Multiplier Works

The gross rent multiplier (GRM) is an easy, back-of-the-napkin formula real estate investors use to narrow down a property search.

GRM is a ratio that compares the property price to the gross annual rent, without accounting for operating expenses or the mortgage payment. Everything else being equal, the lower the GRM is the better deal a property might be because it generates more gross rental income compared to the money invested.

Gross Rent Multiplier Formula

GRM is calculated by dividing the property price by the gross annual rental income:

- GRM = Property Price / Gross Annual Rent

For example, if your $100,000 rental property generates gross annual rents of $14,400 (or $1,200 per month) the GRM would be:

- $100,000 property price / $14,400 gross annual rent = 6.94

You can also rearrange the GRM formula to calculate what the gross annual rent should be. If you know that the market GRM for rental properties similar to the one you are looking at is 6.94, then you know the gross annual rent should be $14,400:

- Gross Annual Rent = Property Price / GRM

- $100,000 property price / 6.94 GRM = $14,409 gross annual rent

How to Project ROI with GRM

The main difference between the ROI and GRM formulas is that the return on investment calculation takes into account operating expenses while the gross rent multiplier calculation does not. That means to project ROI with the GRM formula you need to calculate what the operating expenses are.

When you’re buying a property that’s already rented, you can ask the seller for a P&L (profit and loss) statement. If the property has never been used as a rental, you can put together a pro forma to estimate income and expenses.

Or, you can use the 50% Rule which states that 50% of your gross rental income will be used for normal operating expenses such as repairs and maintenance, property management fees, and insurance and property taxes.

Let’s assume you’re thinking about buying a rental property with a purchase price of $120,000 in an area where similar properties have a GRM of 6.5. When you know these two numbers, you can project ROI with GRM in four steps:

1. Estimate gross rental income

- GRM = Property Price / Gross Annual Rent

- Gross Annual Rent = Property Price / GRM

- $120,000 property price / 6.5 GRM = $18,461 gross annual rent

2. Calculate operating expenses

Using the 50% Rule, you can calculate the annual operating expenses for the property (excluding the mortgage payment):

- $18,461 gross annual rent x 50% = $9,230 operating expenses

3. Calculate cash received

- $18,461 gross annual rent - $9,230 operating expenses = $9,230 cash received

4. Project ROI

- ROI = Cash Received / Cash Invested

- $9,230 cash received / $120,000 cash invested = 0.077 or 7.7%

You can also use the same steps if you are financing the property.

If you’ve been approved for a $120,000 loan with a 25% down payment ($30,000) and a monthly mortgage payment of $379 (principle and interest), your ROI would be:

- $18,461 gross annual rent - $9,230 operating expenses = $9,230 cash received before financing

- $9,230 cash received - $4,548 annual mortgage payment ($379 x 12 months) = $4,682 cash received after financing

- $4,682 cash received / $30,000 cash invested = 0.156 or 15.6% ROI

Other Ways to Use GRM

There are a couple of other ways real estate investors use GRM, in addition to calculating ROI:

Search for properties: GRM is an easy calculation to make to select only the most potentially profitable properties. If your minimum GRM is 6.5, you would only choose properties with a GRM of 6.5 or more for an in-depth analysis.

Fair market value: You can also use the GRM formula to estimate what the value of a property should be by multiplying the gross rental income by the GRM. If a property generates annual gross rent of $15,000 and the GRM is 6.5, the property value should be $97,500.

Conclusion

There are a variety of financial metrics real estate investors use to estimate property value and investment return. Two of the easiest and most useful calculations are gross rent multiplier (GRM) and return on investment (ROI).

Although GRM is used to estimate rental property value, you can also rearrange the formula and use the gross rent multiplier calculation to project ROI in just a few simple steps.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.