2020 US Election: Biden is President-elect, here’s what it means for real estate investors and rental properties

Biden has secured the minimum 270 electoral votes required to win the 2020 US Presidential election. Below is our analysis and insights into how we predict the residential housing market, including rental properties and rental owners, will be affected going into 2021.

New administration prioritizes four major focus areas

While it is anticipated the Trump administration will try to block Biden and impact a smooth transition of power, this President-elect has been in the White House before. While we do not expect to see sweeping changes in legislation, we will most likely see a focus on ‘normalcy’ in governance.

President-elect Joe Biden and Vice President-elect Kamala Harris have already been busy with transition plans for their January 20, 2021 start date. The Biden team updated its website (buildbackbetter.com) to showcase four policy areas the incoming administration will prioritize:

- COVID-19. (Biden has already announced “transition advisers” to create a blueprint to address the coronavirus pandemic.)

- Economic recovery.

- Racial equity.

- Climate change.

The general consensus is a Biden presidency will focus on providing affordable housing and reducing wealth gaps, with financial assistance, incentives and legislation to help Americans buy or rent houses. There will be a push on housing matters through addressing the above four policy areas.

Split of legislative power may present extra resistance for pushing through policy changes

Passing legislation will play a large role in whether the Biden administration will be able to push forward its initiatives. With slim margins on all fronts, political gridlock in all levels of government may prevent many initiatives from coming forward.

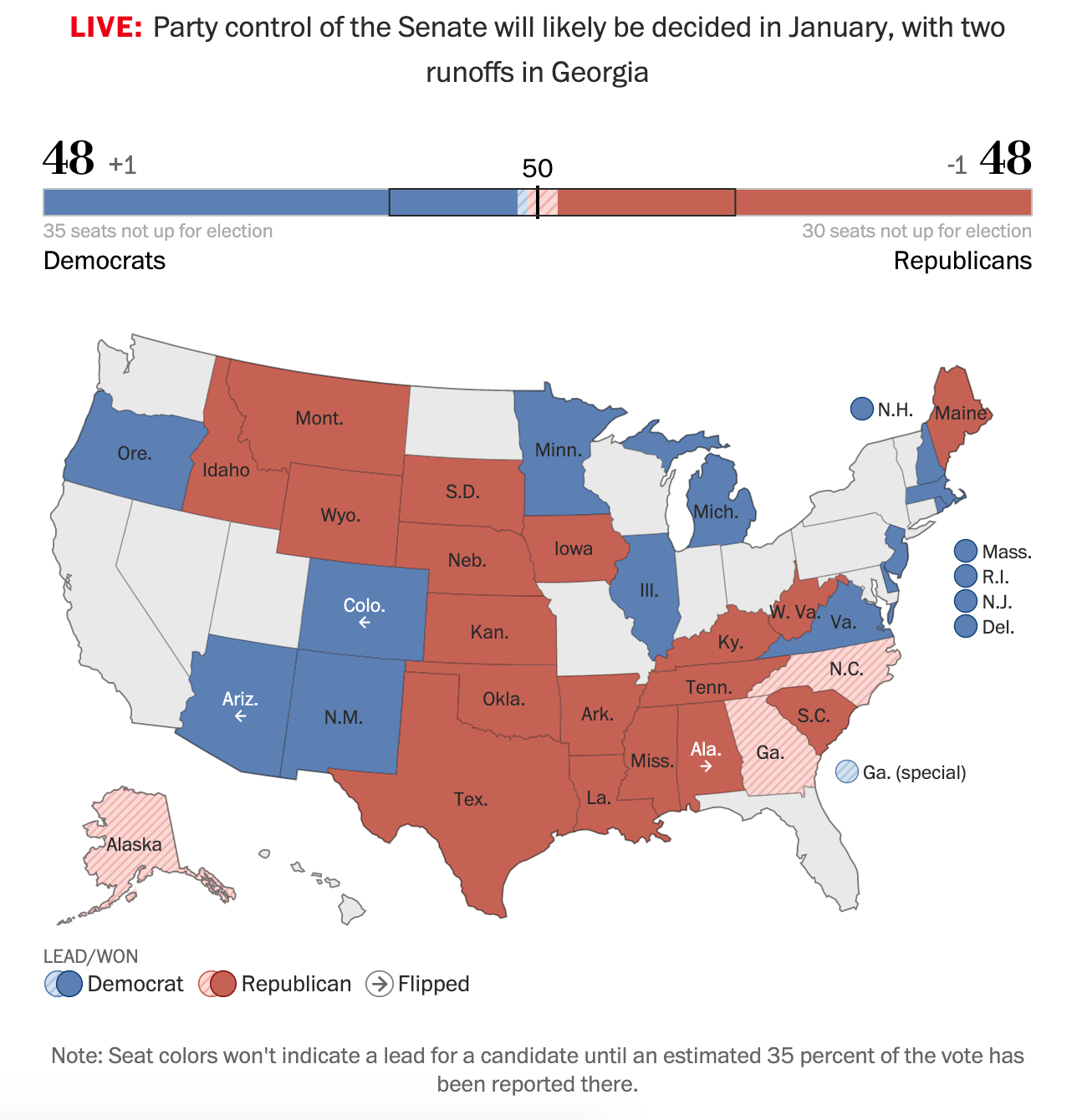

Republican Senate Majority

The White House will have limited power with a Republican Senate majority and specifically, the reputation of Senate majority leader Mitch McConnell to contend with. Senator McConnell has an obstructionist record under Obama where he opposed and blocked Democrative legislation, including nominations for administrative positions (cabinet secretaries, district court judges, and US attorneys). His recent support of President Trump’s legal challenges, saying that Trump is “100 percent within his right” to pursue recounts and litigation, may be a foretelling of things to come.

However, the history between Senator McConnell and President-elect Biden indicates it may not cause the constitutional crisis we may think. We have two years left with McConnell and two Senate run-off races in Georgia on January 5th which could bring about a 50-50 tie in the chamber. Most likely however, the Senate will remain split with a 51-49 Republican lean. With many moderate Republicans in the Senate, according to some sources, Biden may be able to sell on infrastructure-building legislation, as long as it is not sold as green investment.

US Senate election results as of November 9th

Source: Washington Post

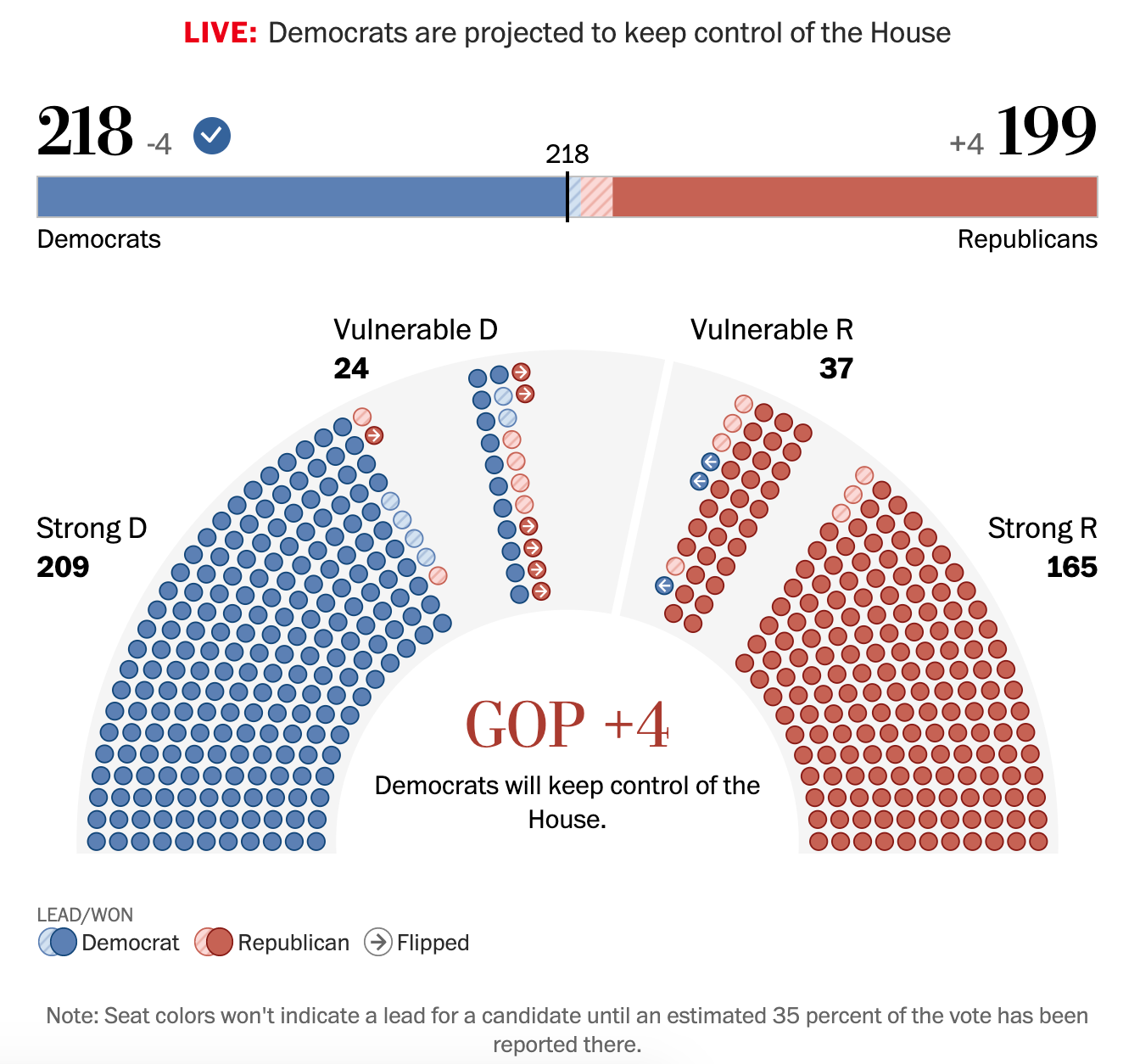

Democratic House Majority

Also a close race, having a Democratic majority now does not mean it will stay that way. How well the new administration’s policies are received may very well impact the House distribution in 2022 and could very well result in a flip of power.

US House elections results as of November 9th

Source: Washington Post

Implications for the Real Estate Industry, Rental Properties and Investors

Tax changes will inevitably change real estate investing behavior

A Biden win and Democratic control of Congress most likely means a shifting tax landscape in many areas. During the campaign in July, Biden unveiled a 10 year, $775 billion plan to fund universal childcare and in-home elder care that would be paid for by taxing real estate investors. This will most likely impact 1031 like-kind exchanges, where investors have been allowed to defer paying taxes on the sale of real estate in the capital gains are reinvested in another property.

Tax increases will hit the upper end of the earning spectrum, including:

- Top rate on ordinary income. Tax rate for singles earning more than $520,000 and married couples earning more than $620,000 per year.

- Long-term capital gains. Capital gains for taxpayers earning more than $1 million per year.

- Payroll taxes. Social Security back on payroll taxes greater than $400,000 (already applied on wages earned up to $137,700).

- Itemized deductions. Phased out for those earning more than $400,000 per year.

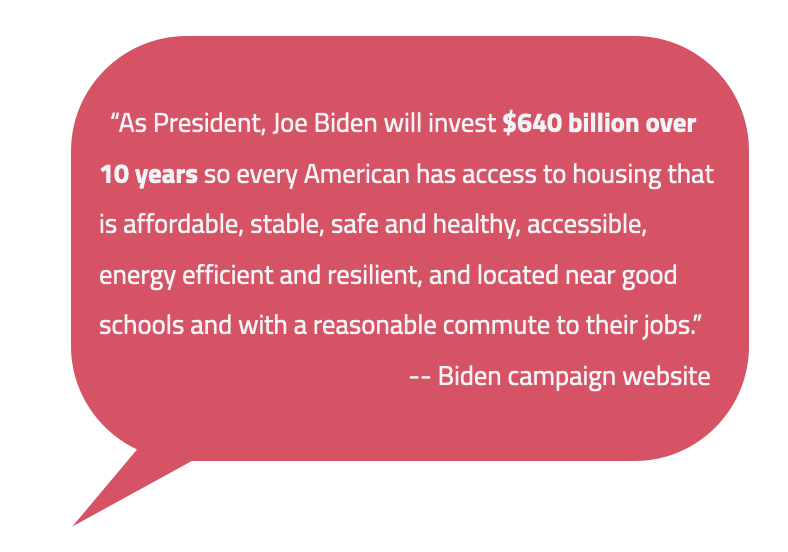

For housing specifically, Biden has pledged $640 billion in investments over the next 10 years. His website claims this will be paid for by raising taxes on corporations and large financial institutions.

Specifically,

- approximately $300 billion of the housing plan is devoted to new construction and is encompassed in the $1.3 trillion infrastructure plan.

- the remaining portion is paid for by instituting a financial fee on certain liabilities of firms with over $50 billion in assets.

The Biden platform will focus on bringing up the middle class and affordable housing initiatives that incentivize investments and improvements for lower-income Americans and communities.

Impact on real estate1031 exchanges and inheritance tax implications

As mentioned above, 1031 exchanges may be eliminated entirely to fund new tax cuts and credits for child and elderly care. The IRS has also recently issued new regulations to define what constitutes real property to determine eligibility. A little history for readers, starting January 1, 2018, the Tax Cuts and Jobs Act (TCJA) permanently eliminated tax-favored Section 1031 treatment for exchanges of personal property. As has always been the case, Section 1031 treatment is only allowed for exchanges of like-kind property that’s held for business or investment purposes.

Pro tip: changes could take effect as early as January 1. Contact your local tax advisor to discuss your options.

Biden is also seeking to eliminate the inheritance tax loophole, stepped-up basis. This tax policy has historically reduced inheritance taxes by resetting the asset value on the date of the original owner’s death. The heir only pays capital gains taxes on the reset value and when they sell, this usually means large sums of money saved from the tax man.

Affordable housing will be a large focus, presenting new opportunities and guidelines for real estate investors and property management companies

Biden will be able to use agencies and regulatory bodies to shape housing policy and there is a comprehensive four-part plan to achieve this:

1. New Homeowner and Renter Bill of Rights.

Modeled on the California Homeowner Bill of Rights, this bill will be geared towards ending redlining and other discriminatory and unfair practices in the housing market.

- For investors,

- prevent mortgage brokers from leading borrowers into loans that cost more than appropriate.

- prevent mortgage servicers from advancing a foreclosure when the homeowner is in the process of receiving a loan modification.

- give homeowners a private right of action to seek financial redress from mortgage lenders and servicers that violate these protections.

- give borrowers the right to a timely notification on the status of their loan modifications and to be able to appeal modification denials.

- Expanded protections for renters,

- Introduce a law prohibiting landlords from discriminating against renters receiving federal housing benefits (read more about section 8 here).

- access legal assistance for tenants facing eviction.

- eviction diversion programs, including mediation, payment plans, and financial literacy education programs.

- Other details:

- It will enact legislation requiring any state receiving federal dollars through the Community Development Block Grants or Surface Transportation Block Grants to develop a strategy for inclusionary zoning, as proposed in the HOME Act of 2019 by Majority Whip Clyburn and Senator Cory Booker.

- $300 million in Local Housing Policy Grants to give states and localities the technical assistance and planning support they need to eliminate exclusionary zoning policies and other local regulations that contribute to sprawl.

- Reinstate the Obama-Biden Administration’s support for those claiming discrimination against major national financial institutions for discriminatory lending practices and reverse the Trump Administration’s requirement for increased proof.

2. Financial assistance to buy or rent, including down payment assistance through a refundable and advanceable tax credit and fully funding federal rental assistance.

a. First Down Payment Tax Credit. Help families buy their first homes and build wealth by creating a new refundable, advanceable tax credit of up to $15,000.

b. Section 8 Housing vouchers to be expanded. Plus, as part of the Homeowner and Renter Bill of Rights, legislation prohibiting landlords from discriminating against renters receiving federal housing benefits.

c. New renter’s tax credit. Designed to reduce rent and utilities to 30% of income for low-income individuals and families who don’t qualify for a Section 8 voucher but still struggle to pay their rent.

d. Expand Good Neighbor Next Door program. Expand housing benefits for first-responders, public school educators, and other public and national service workers who commit to living in persistently impoverished communities or who work in neighborhoods with low affordable housing stock.

e. New public credit reporting agency within the Consumer Financial Protection Bureau to provide consumers with a government option that seeks to minimize racial disparities.

3. Increasing the supply, lowering the cost, and improving the quality of housing, including through investments in resilience, energy efficiency, and accessibility of homes.

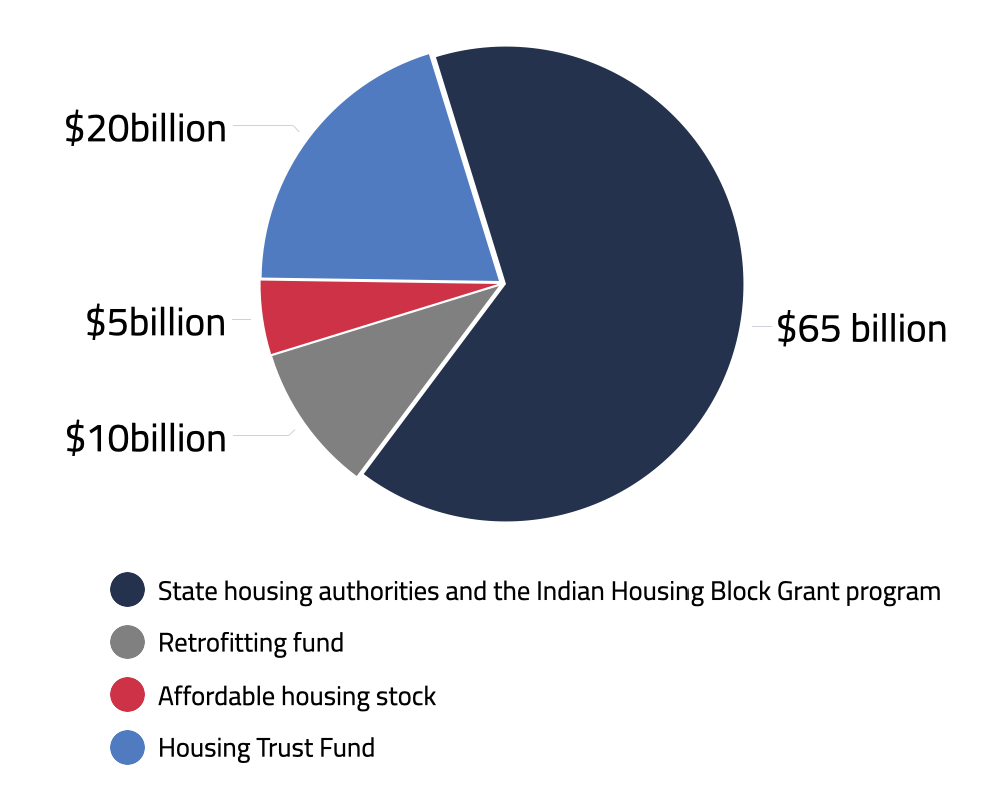

a. $100 billion Affordable Housing Fund to construct and upgrade affordable housing.

b. $10 Billion Low-Income Housing Tax Credit. Biden will also invest in the development and rehabilitation of single family homes across distressed urban, suburban, and rural neighborhoods through the Neighborhood Homes Investment Act.

c. $10 billion over 10 years in Community Development Block Grant. Flexible federal grants for localities to deal with specific challenges and support stabilization and infrastructure.

d. Eliminate local and state housing regulations that limit affordable housing options and contribute to urban sprawl. Increase availability of affordable housing near urban centers.

e. Ensure minority-owned businesses benefit from investment in housing construction and repair.

4. Pursuing a comprehensive approach to ending homelessness. There will be billions on the table to tackle homelessness.

a. Secretary of Housing and Urban Development

i. to lead a task force of mayors and other local elected officials to put on his desk within 100 days a roadmap

ii. conduct a full review of federal housing policies to make sure “housing first” approach is pursued and incentivized

b. Veterans. permanently authorizing the Supportive Services for Veterans Families program, which provides critical funding for wrap-around services for those facing homelessness.

c. LGBTQ protections. secure the passage of the Equality Act, ensuring that no President can ever again single-handedly roll back civil rights protections for LGBTQ individuals, including in housing and homeless shelters.

d. Disabilities and the elderly.

e. Housing for formerly incarcerated individuals.

f. Domestic and sexual violence survivors.

Increasing tax credits for first-time homebuyers and Black and Hispanic homebuyers

The Biden administration plans to implement a tax credit up to $15,000 aimed at helping young, first-time homebuyers and Black and Hispanic homebuyers. This will be greater than the $7,500 tax credit in 2008 (under President Bush) and the $8,000 credit in 2009 (under President Obama).

Fannie Mae and Freddie Mac may not become independent under stricter industry regulation

The Federal Housing Finance Agency (FHFA) and Treasury have been working towards taking the two mortgage giants, Fannie Mae and Freddie Mac, out of government conservatorship. Biden will most likely appoint a new leader of the FHFA to reverse that, with a goal of advancing certain affordable housing goals.

Mortgage rates are expected to increase eventually

According to Housing Wire, regardless of who’s in the White House, observers from across the housing and mortgage industries believe interest rates will continue to hover near historic lows for the next several years and volumes will remain high, largely due to simple economic realities: there simply isn’t enough inventory and the economy is too fragile for rates to increase.

For the mortgage industry, a split government may prevent new tax policies that could impact investment and impact the cost of homeownership. Most likely, fees will be incorporated into mortgage rates to help pay for Biden’s affordable housing initiatives. Biden has further pledged to “review rules by Trump’s housing regulator, which are meant to guard against lending behaviors which disproportionately adversely impact racial minorities or other protected groups.”

Some industry observers speculate as well that increased regulatory authority could lead to increased cost of credit and potentially less supply available.

Asset values are significantly influenced by changes in interest rates and taxation. Investors should watch the Federal Reserve’s involvement over the coming months as economic growth tends to be more stable under its watch. Congress will impact taxation measures and strongly influence investment decisions.

Conclusion

Let’s take a moment to celebrate the fact that this election brought out an all time record number of voters who came out to exercise their democratic right. The close numbers in the House and Legislature demonstrate that our country is very much divided.

Presidential elections have a profound impact on the economy and the stock market. History has shown us that bull markets can happen under both Republican (Reagan) and Democratic (Clinton) leaders. Bear markets also happen under both with Republican Hoover and Democrat Pierce as notable examples. It is interesting to note that Democrat presidents have historically posted higher average stock and housing appreciation, and property in general has been found to perform well under both parties.

As real estate investors, we want to see our investments appreciate in value in real terms. With recent stock market and futures gains, it seems that markets think the balance in the legislature will be good for business.

Regardless of the result, we can all agree that stable interest rates and fair tax policies that encourage investment are good for all of us.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.